Best of Bootstrapping: Bootstrapped First, Raised Money Later from Udupi, Karnataka

If you haven’t already, please study our Bootstrapping Course and Investor Introductions page.

Robosoft Founder Rohith Bhat started a services company in his hometown – a small town on the west coast of Karnataka, India. When we spoke in 2017, fifteen years later, the company was generating $18 million in revenue and had raised two sizable rounds of VC funding. I found the story exhilarating!

Sramana Mitra: Let’s go to the very beginning of your journey. Where are you from? Where were you born, raised, and in what kind of background?

Rohith Bhat: I was born in Udupi, India. It’s a small town on the west coast of the country. Then I went to the local school and university and studied engineering and computer science in 1992. Once I finished engineering, I had an opportunity to go on to work for a company in Japan for Recosoft. I worked for this company for around three and a half years.

Featured Videos

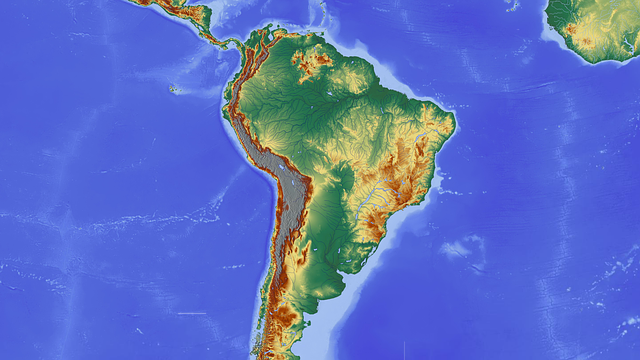

11 Udemy Courses On How To Raise Seed Funding in Latin America

If you are building a startup in Latin America, this course may enhance your understanding of Latin American startup financing. You’ll get knowledge from real-world Latin American investors as if you had a chance to have a mentor advice session with them. To apply current discount coupons, click on the courses found HERE.

>>>Facebook Gets the Thrashing it Deserves

Facebook (Nasdaq: FB) recently announced its fourth-quarter financials that sent its stock plummeting. The company suffered its biggest one-day wipeout ever with its stock sliding 26%, wiping out more than $230 billion of its market value. The company actually reported the first-ever user decline in 18 years, causing the big upheaval. Also, Apple has tightened the privacy screws on Facebook, taking away serious targeting capabilities. Most likely, a lot more grief is on the way for the company as EU privacy rules also start to kick in gear on privacy issues.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Thought Leaders in Artificial Intelligence: Muddu Sudhakar, CEO of Aisera (Part 1)

Aisera is doing some incredibly advanced stuff with AI-driven workflow automation within the customer service space.

Muddu talks eloquently about these innovations. Read on!

Sramana Mitra: Let’s start by introducing our audience to yourself as well as Aisera.

>>>Thought Leaders in Artificial Intelligence: Sonny Tai, CEO of Actuate AI (Part 1)

Sonny talks about AI in the physical security industry.

Sramana Mitra: Let’s introduce our audience to yourself as well as to Actuate AI.

Sonny Tai: I’m the CEO and Co-Founder of Actuate. We are a New York-based AI startup. I was born in Taiwan, but I grew up in South Africa. I’m an immigrant to the United States.

>>>558th 1Mby1M Entrepreneurship Podcast with Deepak Balakrishna, Adya

Deepak Balakrishna, Co-founder CEO of Adya, which was acquired by Qualys. We review his lessons from the trenches, steering a Bootstrapping to Exit transaction.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

Solo Entrepreneur Bootstrapping with a Paycheck to over $15M Revenue: SoPost CEO Jonny Grubin (Part 7)

Sramana Mitra: How much did you raise in the second round?

Jonny Grubin: Probably about £300,000. In total, we raised about £900,000.

Sramana Mitra: Excellent. I love capital-efficient businesses.

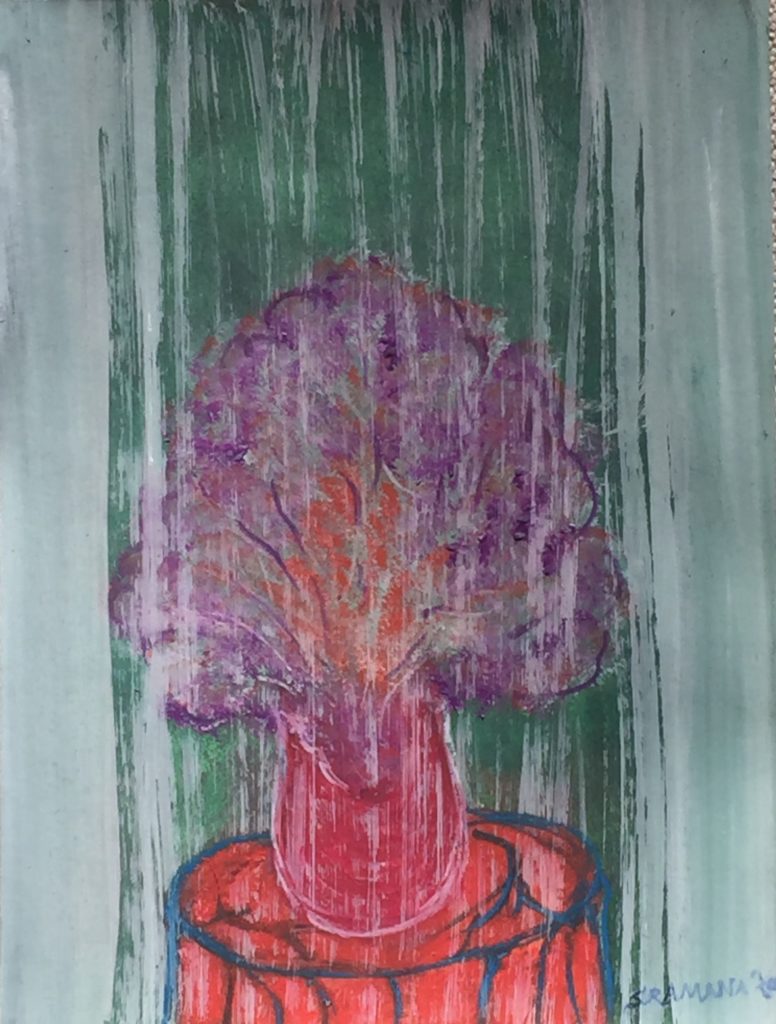

>>>Colors: Purple Blossoms

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Purple Blossoms

Purple Blossoms | Sramana Mitra, 2020 | Watercolor | 9 x 12, On Paper