Accelerator Conundrum in Wales’ Startup Ecosystem

Wales has an emerging and dynamic startup ecosystem, concentrated primarily in Cardiff, Swansea, and Newport. With a strong technical talent base, university support, and government initiatives, Wales is producing promising IT and IT-enabled services startups. Yet the Accelerator Conundrum is evident: founders are often pushed to chase funding and rapid growth before validating ideas, acquiring customers, or establishing sustainable operations.

>>>Featured Videos

Accelerator Conundrum in Ireland’s Startup Ecosystem

Ireland has established itself as one of Europe’s leading technology hubs, with startup activity concentrated in Dublin, Cork, Galway, and Limerick. The country benefits from a highly skilled, English-speaking workforce, a strong IT and SaaS sector, and international corporate presence. Yet the Accelerator Conundrum remains: founders often feel compelled to pursue early-stage funding and rapid scaling before validating product-market fit, generating revenue, or building sustainable operations.

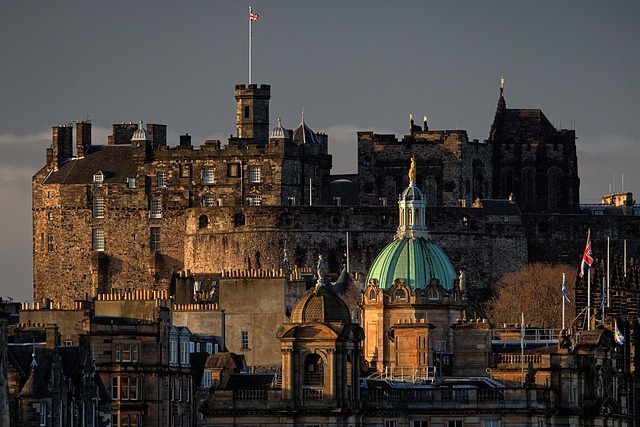

>>>Accelerator Conundrum in Scotland’s Startup Ecosystem

Scotland has a vibrant and growing startup ecosystem, with activity concentrated in Edinburgh, Glasgow, Aberdeen, and Dundee. The country benefits from world-class universities, strong technical talent, and a history of innovation, particularly in IT and IT-enabled services. Yet the Accelerator Conundrum is evident: founders are often encouraged to chase early-stage funding and rapid scaling before validating their business fundamentals, leading to operational stress, equity dilution, and founder burnout.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Accelerator Conundrum in England’s Startup Ecosystem

England has a mature and diverse startup ecosystem, with activity concentrated in London, Manchester, Cambridge, Bristol, and Birmingham. The country benefits from world-class universities, deep technical talent, and a strong culture of entrepreneurship. Yet the Accelerator Conundrum is present: founders are often encouraged to pursue rapid fundraising and ambitious scaling before validating their products, acquiring paying customers, and building sustainable operations. Many entrepreneurs face burnout and operational stress as they chase high growth benchmarks set by the venture ecosystem.

>>>Baltic Accelerator Conundrum: Lithuania’s Startup Ecosystem

Lithuania has quietly become one of Europe’s most interesting entrepreneurial laboratories. Small, ambitious, and digitally savvy, it has managed to build an ecosystem that punches well above its weight — particularly in fintech, SaaS, and digital services. Yet, even here, amidst the country’s success stories, the Accelerator Conundrum is alive and well: the tendency to equate fundraising with progress, rather than seeing fundraising as one tool among many in building sustainable ventures.

>>>Baltic Accelerator Conundrum: Latvia’s Startup Ecosystem

Latvia has come a long way since the early 2010s when its startup ecosystem was barely visible on the European map. Today, Riga, the country’s capital, is a lively node in the Northern European innovation corridor — small, efficient, globally oriented, and full of raw entrepreneurial energy. Yet, beneath the surface of this growing ecosystem lies a familiar challenge I have observed in dozens of markets around the world: the Accelerator Conundrum.

>>>Baltic Accelerator Conundrum: Estonia’s Startup Ecosystem

Estonia is the poster child of digital transformation. From e-governance to paperless bureaucracy, the country has built an identity as the “Digital Republic.” It consistently ranks among the most startup-friendly environments in Europe. Founders in Tallinn and Tartu have proven that a small country can build world-class technology companies — Skype, Wise, Bolt, Pipedrive, and Veriff are all powerful testaments to that spirit.

>>>Eastern Europe’s Accelerator Conundrum: Slovakia’s Startup Ecosystem

Slovakia’s startup ecosystem is emerging steadily, centered in Bratislava, with growing activity in Košice and Žilina. While smaller than neighboring Central European markets, Slovakia has a pool of highly skilled IT talent, producing promising IT and IT-enabled services ventures. Yet, the Accelerator Conundrum is evident: founders often focus on securing early funding rather than building a validated, revenue-generating business.

>>>