Belgium’s Startup Accelerator Ecosystem: Charleroi is an Emerging IT Services Hub

Charleroi, traditionally an industrial city, is emerging as a hub for IT-enabled service startups and digital solutions. While smaller than Brussels or Ghent, Charleroi offers founders the opportunity to engage with niche accelerators, local enterprises, and early adopters, particularly in B2B software and SME-focused IT solutions.

>>>Featured Videos

Belgium’s Startup Accelerator Ecosystem: Liège Focuses on Industrial & Smart IT Solutions

Liège represents a smaller but strategically important hub for IT and IT-enabled service startups in Belgium. Traditionally known for its industrial base, the city is evolving to support smart industrial solutions, B2B SaaS, and IT-enabled digital services. Founders in Liège have access to accelerators, local corporate networks, and niche investors, but the ecosystem is limited in scale compared with Brussels, Antwerp, or Ghent.

>>>Belgium’s Startup Accelerator Ecosystem: Leuven Offers Academic IT Spinouts & Deep Digital Tech

Leuven is synonymous with research-driven innovation, anchored by KU Leuven, one of Europe’s leading technical universities. For IT and IT-enabled services startups, Leuven offers access to talent, research labs, and specialized mentorship, particularly for founders emerging from academic or deep tech backgrounds.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Belgium’s Startup Accelerator Ecosystem: Ghent Emphasizes AI & Digital Services

Ghent is one of Belgium’s most vibrant tech ecosystems, distinguished by a strong focus on AI, digital platforms, and IT-enabled services. The city benefits from a mix of academic research, innovation-driven accelerators, and a growing startup community. For IT founders, Ghent represents an ideal environment to validate products, access mentorship, and engage with early customers.

>>>Belgium’s Startup Accelerator Ecosystem: Antwerp Leads Port & Logistics IT Innovation

Antwerp is Belgium’s industrial and logistics hub, a city defined by its port — one of Europe’s largest — and its deep industrial networks. For IT and IT-enabled service startups, Antwerp offers unique opportunities, particularly in logistics tech, enterprise software, and B2B SaaS solutions. Founders who understand the industrial and commercial landscape can leverage local accelerators and corporate partnerships to gain early traction.

>>>Belgium’s Startup Accelerator Ecosystem: Brussels is the Corporate IT Hub

Brussels is Belgium’s political and corporate heartbeat, and for IT and IT-enabled services startups, it represents the densest concentration of accelerators, investors, and corporate innovation programs in the country. The city is home to both established accelerators and specialized corporate programs, offering founders access to mentorship, networking, and early-stage funding. However, these advantages come with constraints that many solo founders and bootstrapping founders overlook until they are deep in the program.

>>>Belgium’s Startup Accelerator Ecosystem: An Overview

Belgium’s startup accelerator ecosystem is geographically diverse and highly sector-driven, with hubs in Brussels, Antwerp, Ghent, Leuven, Liège, and Charleroi. For IT and IT-enabled services startups — the core focus of 1Mby1M — Belgium presents both opportunity and challenge. These hubs provide accelerators, corporate partnerships, and specialized networks, but they also illustrate the persistent accelerator conundrum: founders are given access and visibility, yet often lack actionable guidance for building revenue-first, capital-efficient businesses.

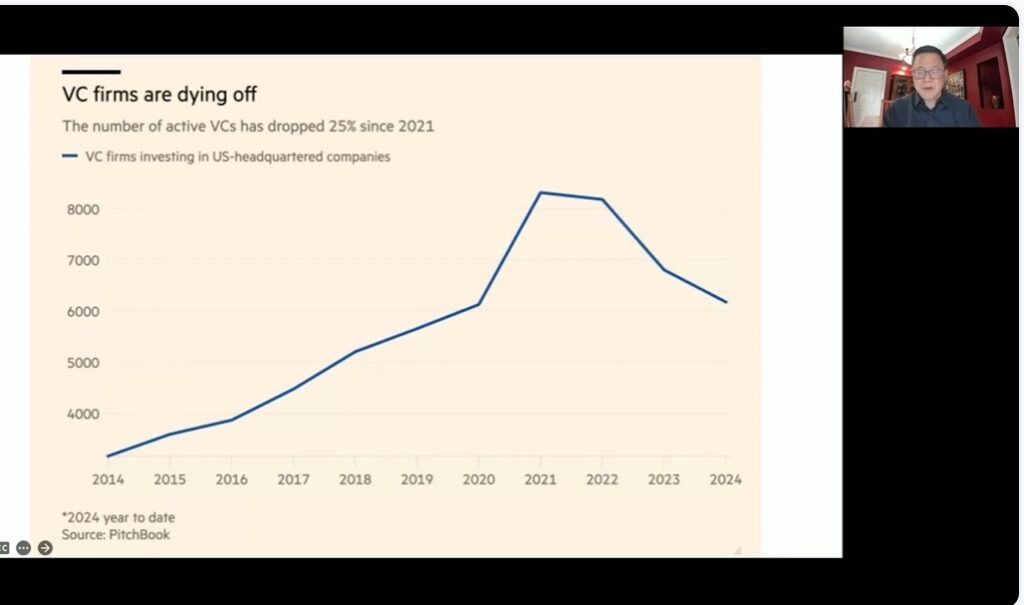

>>>1Mby1M Virtual Accelerator AI Investor Forum: Investor Gus Tai on VC Industry Size (Part 1)

Gus Tai is a veteran Venture Capitalist and a close friend. We discuss why the Venture Capital or VC industry size needs to shrink.

>>>