Cloud Stocks: Google’s Acquisition of Mandiant Fuels its Cloud Strategy

Google’s (Nasdaq: GOOG) recently reported first-quarter results failed to impress the market’s expectations. The company is stepping up focus on its cloud offerings as it tries to expand its share in the market. But its disappointing results sent the stock tumbling 18% in the after-hours trading session.

>>>Featured Videos

Best of Bootstrapping: Bootstrapping Under30Experiences to $5M

If you haven’t already, please study our Bootstrapping Course and Investor Introductions page.

Under30Experiences Co-founder Matt Wilson has built a fantastic business using content marketing to sell travel experiences to a millennial demographic. Very cool! Here is our conversation from 2019.

Sramana Mitra: Let’s start at the very beginning of your journey. Where are you from? Where did you grow up and in what kind of background?

Matt Wilson: I grew up in upstate New York. I grew up in a little tiny town called Stormville, New York. It’s about 60 minutes outside of New York City. It’s not really that close to the city, but it wasn’t extremely rural. I just started being an enterprising young man whether it was by mowing lawns or picking golf balls out of the local ponds. Selling the golf balls on eBay was my first online business. That really ignited the passion for entrepreneurship. Baseball cards would probably be the other thing that I was really passionate about when I was younger.

1Mby1M Virtual Accelerator Investor Forum: With Julie Lein, Managing Partner at Urban Innovation Fund (Part 1)

Julie Lein, Managing Partner at Urban Innovation Fund, discusses pre-seed and seed funding in companies focused on the betterment of cities.

Sramana Mitra: Let’s get you and Urban Innovation Fund introduced to our audience.

Julie Lein: I’m the Co-Founder and Managing Partner of the Urban Innovation Fund. We are a venture capital firm that invests in startups shaping the future of cities. We invest across a variety of verticals. These are what you might consider more traditional smart city sectors like transportation, energy, PropTech.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Leveraging Channels and Slovenia to build Successful Businesses: Simon Taylor, CEO of HYCU (Part 1)

Simon offers excellent insights into creating an unfair advantage with unique engineering team leverage in off-center locations. He also discusses creative channel strategy techniques.

Sramana Mitra: Let’s start at the very beginning of your journey. Where are you from? Where were you born, raised, and in what kind of background?

>>>Catching Up On Readings: LatAm Startup Ecosystem 2022

This feature from Crunchbase News analyzes what the Latin American startup ecosystem will look like by the end of 2022. There were 18 unicorns in LatAm in 2021, and the stabilized confidence in the region will drive new opportunities, and more diverse players are expected to enter the space. For this week’s posts, click on the paragraph links.

>>>573rd 1Mby1M Entrepreneurship Podcast with Steve Eskenazi, Angel Investor

Steve Eskenazi is an Angel Investor, and we had a number of interesting trend conversations.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

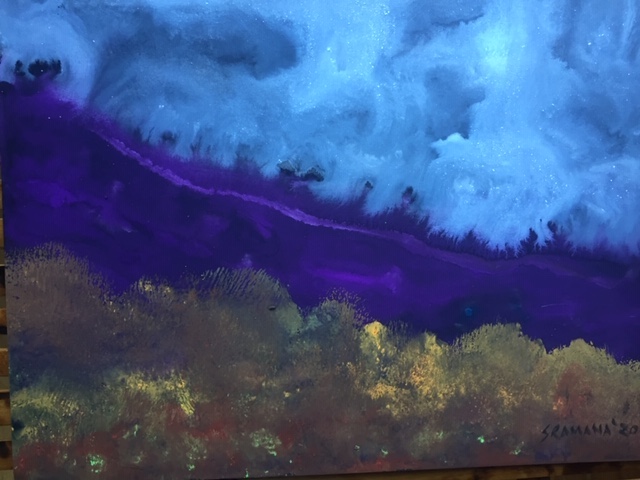

Colors: Fall Reverie VI

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Fall Reverie VI

Fall Reverie VI | Sramana Mitra, 2020 | Watercolor, Pastel, Brush Pen | 9 x 12, On Paper

Applying AI to Lead Generation: Rev CEO Jonathan Spier (Part 6)

Sramana Mitra: We have tried to move the software industry into this DIY model. The whole SaaS industry is a DIY model. Ho and I were talking about the opportunity to do a DIFM (Do It For Me). Years ago, I coined another phrase to describe those – SaaS-enabled BPO.

There is technology, but the technology is being used by the services agency that is applying that technology to achieve significant results, but people are not using the software. They’re using the functionality of this vendor. It sounds like you are doing DIFM kind of model.

Jonathan Spier: When I signed on, that’s the model. Now, we’re doing both. At the end of the day, you want to solve the problem for a customer. That’s where you unlock a lot of value. Never mind the definitions put on it.

>>>