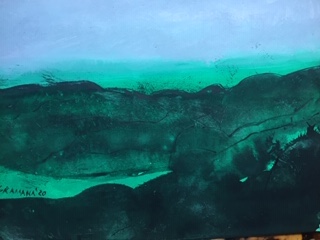

Colors: Les Pins I

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Les Pins I

Les Pins I | Sramana Mitra, 2020 | Watercolor, Pastel, Brush Pen | 9 x 12, On Paper

Featured Videos

Colors: Green Valley II

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Green Valley II

Green Valley II | Sramana Mitra, 2020 | Watercolor, Pastel, Brush Pen | 9 x 12, On Paper

Bootstrapping Using Services and Piggybacking from Australia: StoreConnect CEO Mikel Lindsaar (Part 6)

Mikel Lindsaar: The really cool thing about StoreConnect business model is that Salesforce gets their license revenue and they get a very sticky customer who then is investing more into the platform. The partners love it because they get a client who has an upfront setup fee but has a part of their business related to that partner’s consulting revenue.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Cloud Stocks: Couchbase Focuses on Improving Efficiencies for Developers

The NoSQL database market is expected to grow at 28% CAGR to reach $24.9 billion industry by 2027 driven by the continuing rapid adoption of e-commerce applications and web applications. Recently listed Couchbase (Nasdaq: BASE) is a leading vendor in the market that recently announced its first-quarter earnings.

>>>Bootstrapping Using Services and Piggybacking from Australia: StoreConnect CEO Mikel Lindsaar (Part 5)

Sramana Mitra: Is this a global customer base?

Mikel Lindsaar: Yes. We’re focused on Australia while we were launching it, but we’ve got customers in America, and companies in Australia that have stores in Singapore, the UK, and Europe. We now have two or three partners in America. That’s all going to kick off this year as we do our America expansion.

The goal is to get it up to a point where someone acquires us. I’d be very surprised if Salesforce doesn’t acquire. It’s an SMB e-commerce solution that they don’t have. They can’t take their B2C solution and make it small business-friendly because it’s going to piss off their enterprise customers. They just can’t reprice it. StoreConnect has been interesting. Our first investor was our first client.

>>>Dutch Student Entrepreneurs Building a Large Scale EdTech Marketplace: StuDocu CEO Marnix Broer (Part 5)

Marnix Broer: We didn’t really have to dilute ownership to raise €100,000. However, if we didn’t have the €100,000, the decisions we made were probably tougher to make. If you have some money, you dare to take a bit more risk. It might have actually made a difference.

Later on in 2016, we raised from two venture capitalists – one in Amsterdam and one from Berlin. We showed them that we had a great working system in the Netherlands. We had a product-market fit. We were making revenues. We’ve just done the test in Belgium, Spain, and Australia. The students love the product as well.

>>>Cloud Stocks: Confluent Expands Ecosystem with Microsoft and AWS

According to Gartner, the global application infrastructure middleware market is projected to grow at 10% CAGR to $ 83.1 billion by 2027 from $ 47.5 billion in 2021. Silicon Valley-based Confluent is a leading player in the sector that operates a data streaming platform. Its managed cloud-native service for connecting and processing data and an enterprise-grade self-managed software, which connects and processes data in real-time with the foundational platform for data in motion, are seeing strong market adoption as was evident in its recent results.

>>>Bootstrapping Using Services and Piggybacking from Australia: StoreConnect CEO Mikel Lindsaar (Part 4)

Sramana Mitra: Where did this idea come from?

Mikel Lindsaar: From the services business. reinteractive does a lot of customer applications connected to Salesforce.

Sramana Mitra: Are all your product ideas from your services business?

Mikel Lindsaar: MetaPulse was something that I always wanted to build. I created my services business so I can create MetaPulse. StoreConnect came out of reinteractive.

>>>