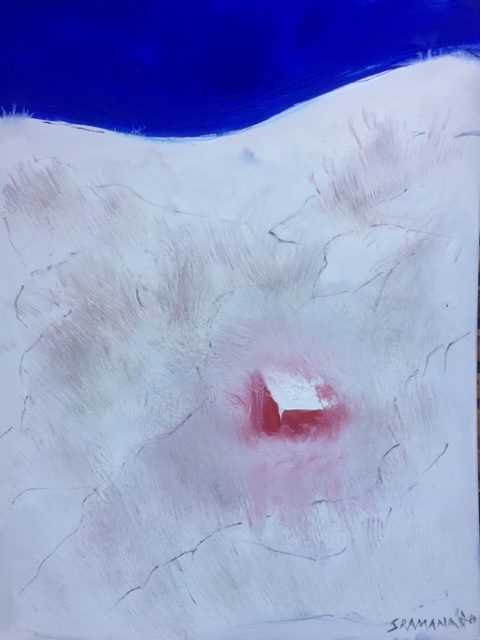

Colors: Norwegian Winter II

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Norwegian Winter II

Norwegian Winter II | Sramana Mitra, 2020 | Watercolor, Brush Pen | 9 x 12, On Paper

Featured Videos

Roundtable Recap: March 10 – Spotlight on PropTech

During this week’s roundtable, we had as our guest Zain Jaffer, Partner at Blue Field Capital, discussing trends in PropTech.

Pathaway

As for entrepreneur pitch today, we had Crystal Williams from Cleveland, Ohio, pitch Pathaway. She has an interesting decision ahead: to build a business or do a non-profit with her concept.

You can listen to the recording of this roundtable here:

From Developer to Successful Machine Learning Entrepreneur: David Moss, Co-Founder, President and CTO of People Power Company (Part 6)

Sramana Mitra: Your Series A was mostly angels?

David Moss: There were some traditional VCs in Series A as well.

Sramana Mitra: What was the size of the Series A?

David Moss: I think it was around $4 million. With Series B, we filled it out with more corporate investors. They also turned into customers.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Duolingo Benefits from Google Play Fee Reduction

Language learning service provider Duolingo (Nasdaq: DUOL) recently announced its fourth-quarter results. The company had listed last summer, but has failed to maintain its list price since. It continues to invest in growth by building on its content and user engagement strategy and believes that it can compete with other media streaming players as well. The recent app store price cut is expected to help Duolingo significantly.

>>>From Developer to Successful Machine Learning Entrepreneur: David Moss, Co-Founder, President and CTO of People Power Company (Part 5)

David Moss: The third thing we do is we’re bringing people together. If we look at the history of computing, in every era, killer apps would emerge. These apps were killer because they’re viral. They’re viral because they’re social. What’s key is to take the newest technology of the day and find how we can intersect that with elements that are social.

There is nothing more social than taking care of somebody. We are bringing together family caregivers and we are bringing together professional caregivers to provide care. Usually, it’s a primary caregiver who steps up. This person has a lot of stress. What we need to do is distribute that stress to the rest of the family and provide them with a better lifestyle.

>>>Israeli Founders Building a FinTech Venture: Omri Dor, Co-Founder and COO of Obligo (Part 4)

Sramana Mitra: What about customers? Did you have customers?

Omri Dor: That was the straw that broke the camel’s back. Roey and I did a couple of trips to London. We went there and were going door-to-door to residential brokers. We would walk in and show them the demo and a video. It was an explainer video. We would walk door-to-door getting them to sign letters of intent. I believe we got zero.

>>>567th Roundtable For Entrepreneurs Starting NOW: Live Tweeting By @1Mby1M

Today’s 567th FREE online 1Mby1M Roundtable For Entrepreneurs is starting NOW, on Thursday, March 10, at 8 a.m. PST/11 a.m. EST/5 p.m. CET/9:30 p.m. India IST. CLICK HERE to join. PASSWORD: startup All are welcome!

567th Roundtable For Entrepreneurs Starting In 30 Minutes: Live Tweeting By @1Mby1M

Today’s 567th FREE online 1Mby1M Roundtable For Entrepreneurs is starting in 30 minutes, on Thursday, March 10, at 8 a.m. PST/11 a.m. EST/5 p.m. CET/9:30 p.m. India IST. CLICK HERE to join. PASSWORD: startup All are welcome!