June 2 – 577th 1Mby1M Mentoring Roundtable for Entrepreneurs

Entrepreneurs are invited to the 577th FREE online 1Mby1M Mentoring Roundtable on Thursday, June 2, 2022, at 8 a.m. PDT/11 a.m. EDT/5 p.m. CEST/8:30 p.m. India IST.

If you are a serious entrepreneur, register to “pitch” and sell your business idea. You’ll receive straightforward feedback, advice on next steps, and answers to any of your questions. Others can register to “attend” to watch, learn, and interact through the online chat.

You can learn more here and REGISTER TO PITCH OR ATTEND HERE. Register and you will receive the recording by email, even if you are unable to attend. Please share with any entrepreneurs in your circle who may be interested. All are welcome!

Featured Videos

Analysis of BigCommerce’s Acquisitions

E-commerce platform BigCommerce recently reported its first-quarter results that outpaced market expectations. According to a recent report, the global B2B e-commerce market is estimated to grow at 18% CAGR to $25.65 trillion by 2028. BigCommerce is looking to capture this market through acquisitions.

>>>1Mby1M Virtual Accelerator Investor Forum: With Steve Eskenazi, Angel Investor (Part 2)

Sramana Mitra: Let’s do some more examples of the kinds of companies you like to invest in. Is Resonato an IT investment?

Steve Eskenazi: It’s a technology company that occupies the intersection of technology and consumer electronics. Our first TVs were thick. Now, TVs are very thin. They are doing for the speaker market what was done to the TV market. They are making flat-core speakers. They don’t make the speakers. They license their technology. They’re heavily patent-protected.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

1Mby1M Virtual Accelerator Investor Forum: With Andrus Oks, Founding Partner of Tera Ventures (Part 2)

Sramana Mitra: How do the Estonian culture and entrepreneurial momentum play into your investment strategy? Are you looking for people to have developer shops in Estonia or some kind of backend in Estonia?

Andrus Oks: Estonia is very special. To put in context, it is a small country with a population of 1.3 million. We actually have 10 Estonian unicorns. Last year, it was more than a billion dollars in investment. This year, it’s already more than a billion dollars. This is very helpful. We achieved this quite fast as well.

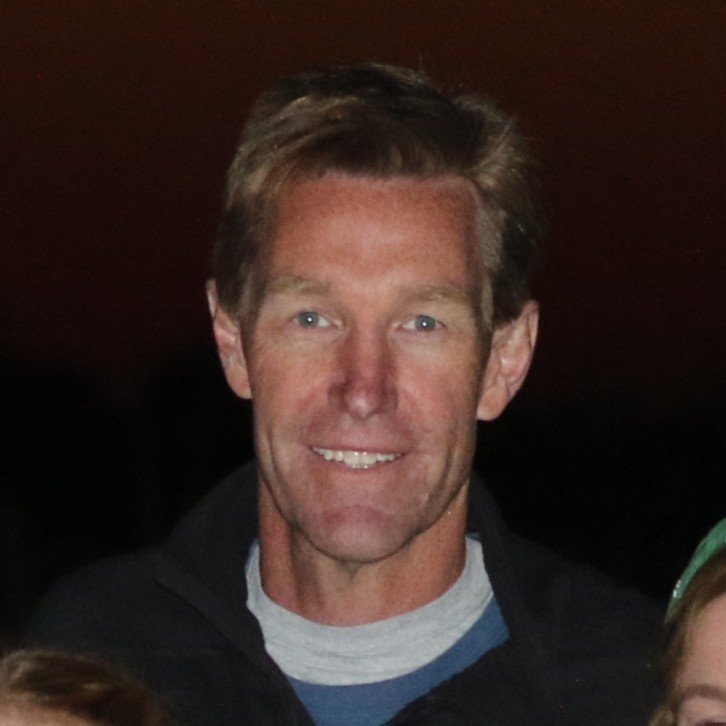

>>>20-Year Journey of a Fat Startup with Major Pivots: Scott Sellers, CEO of Azul (Part 1)

VCs invest in startups that go from zero to $100M in 5 to 7 years. It has taken Azul almost 20 years to make that journey. Scott discusses the pivots and strategic shifts that have made the journey possible. With patience and persistence, and with an excellent two-pronged Open Source strategy, Scott has built Azul into a compelling business with many exit options from IPO to various acquisition paths.

>>>1Mby1M Virtual Accelerator Investor Forum: With Andrus Oks, Founding Partner of Tera Ventures (Part 1)

Andrus Oks is Founding Partner at Tera Ventures, based in Estonia. We have a great discussion on entrepreneurship in the Baltic and Scandinavian countries in particular.

Sramana Mitra: Let’s start by introducing our audience to yourself as well as Tera Ventures.

Andrus Oks: I’m one of the founding partners of Tera Ventures. Tera is an Estonian-based seed fund. We currently invest from our €45 million second fund. We are halfway through. We have done 15 deals. We are doing another 15. We support our portfolio companies throughout the rounds. We like to be early. We’re often the first investors.

>>>Thought Leaders in Artificial Intelligence: Florian Eggenschwiler, Chief Product Officer of Xovis (Part 4)

Sramana Mitra: How many partners do you have?

Florian Eggenschwiler: About 200 plus of various sizes.

Sramana Mitra: Is it more of the smaller ones?

Florian Eggenschwiler: I would say there is a slight skew towards the smaller companies. They tend to be locally focused and are quite flexible to react to local requirements.

>>>Catching Up On Readings: Big Tech’s Talent Bonanza

This feature by Christopher Mims on The Wall Street Journal discusses how the tech crash could be a talent bonanza among the Big Tech. For this week’s posts, click on the paragraph links.

>>>