1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 4)

Sramana Mitra: Yanni, you said you are investing in superintelligence. Tell me more about what you’ve invested in and your thesis on superintelligence.

>>>Featured Videos

Building a Startup as a Solo Entrepreneur

For the longest time, there has been a stigma around solo entrepreneurs. Y Combinator doesn’t really like solo entrepreneurs. VCs don’t like to fund solo entrepreneurs. So what do you do if you want to do your venture as a solo entrepreneur?

I think you should go ahead.

If you play your hand smartly, you can succeed.

1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 3)

Sramana Mitra: Yeah. So, Yev, I want to make a point, and I want your thoughts on it.

We hear a lot from people saying, “This is just a wrapper on top of ChatGPT.” But there is a lot of domain knowledge in specific verticals that you can solve very well with a wrapper on top of ChatGPT, because the domain knowledge is where the real work is happening.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Top Accelerators for Marathon not 3-month Sprint in Mumbai

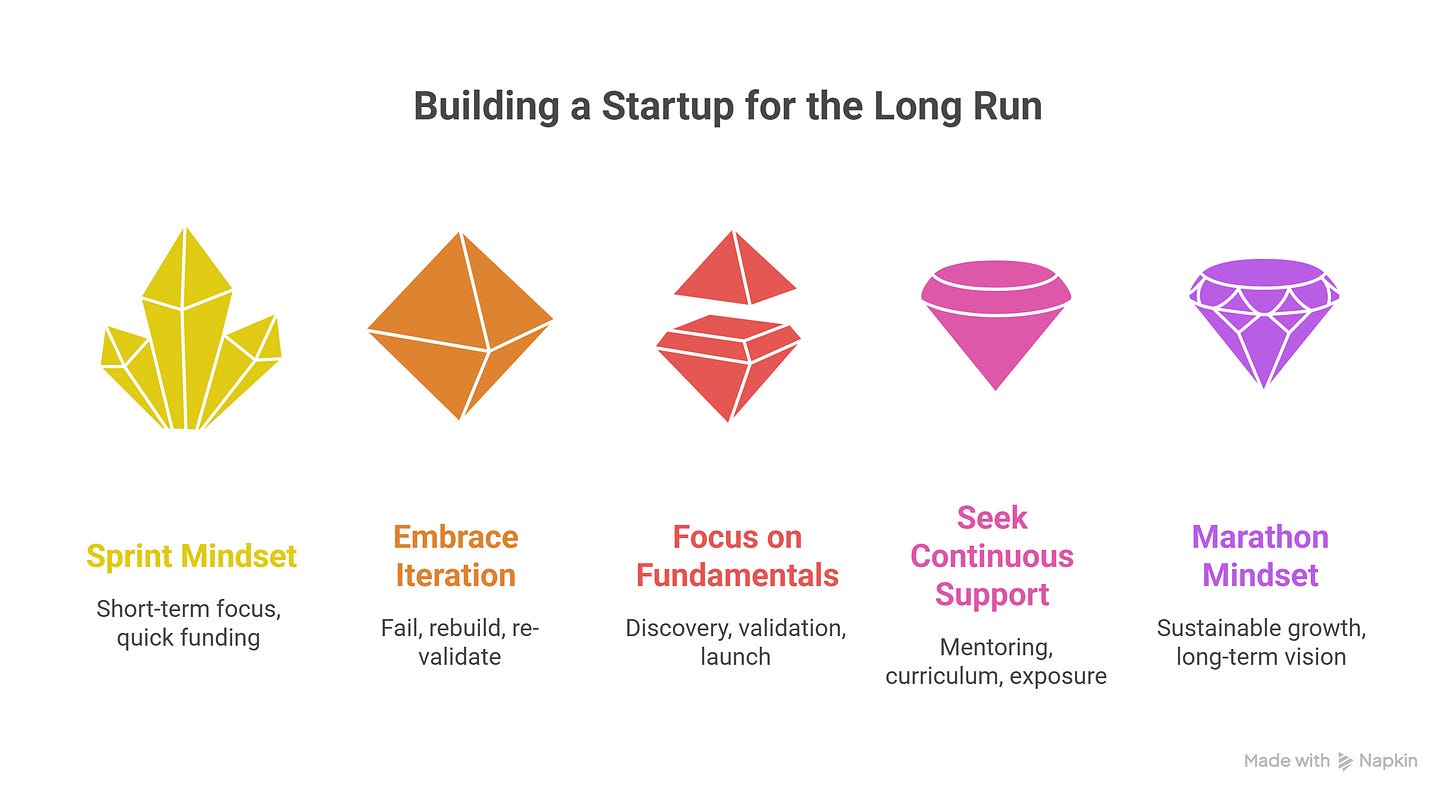

The 3-Month Myth

A 90-day program can change a life—but rarely builds a company. Most Mumbai accelerators run on a fixed calendar: 12 weeks, a demo day, and then it’s over. But real founders don’t build in quarters. They build in cycles. They fail, rebuild, and re-validate over time.

This post profiles Mumbai accelerators that go beyond the 3-month model—in spirit, structure, or support.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 2)

Sramana Mitra: Very true. This is very true. I want to underscore that you should not raise money at the highest valuation you can, because you’re pricing yourself out of the exit market and out of further fundraising. If you don’t meet milestones that are that aggressive and far ahead of the curve, you will be stuck.

>>>Top Accelerators for Long Term Mentoring in Mumbai

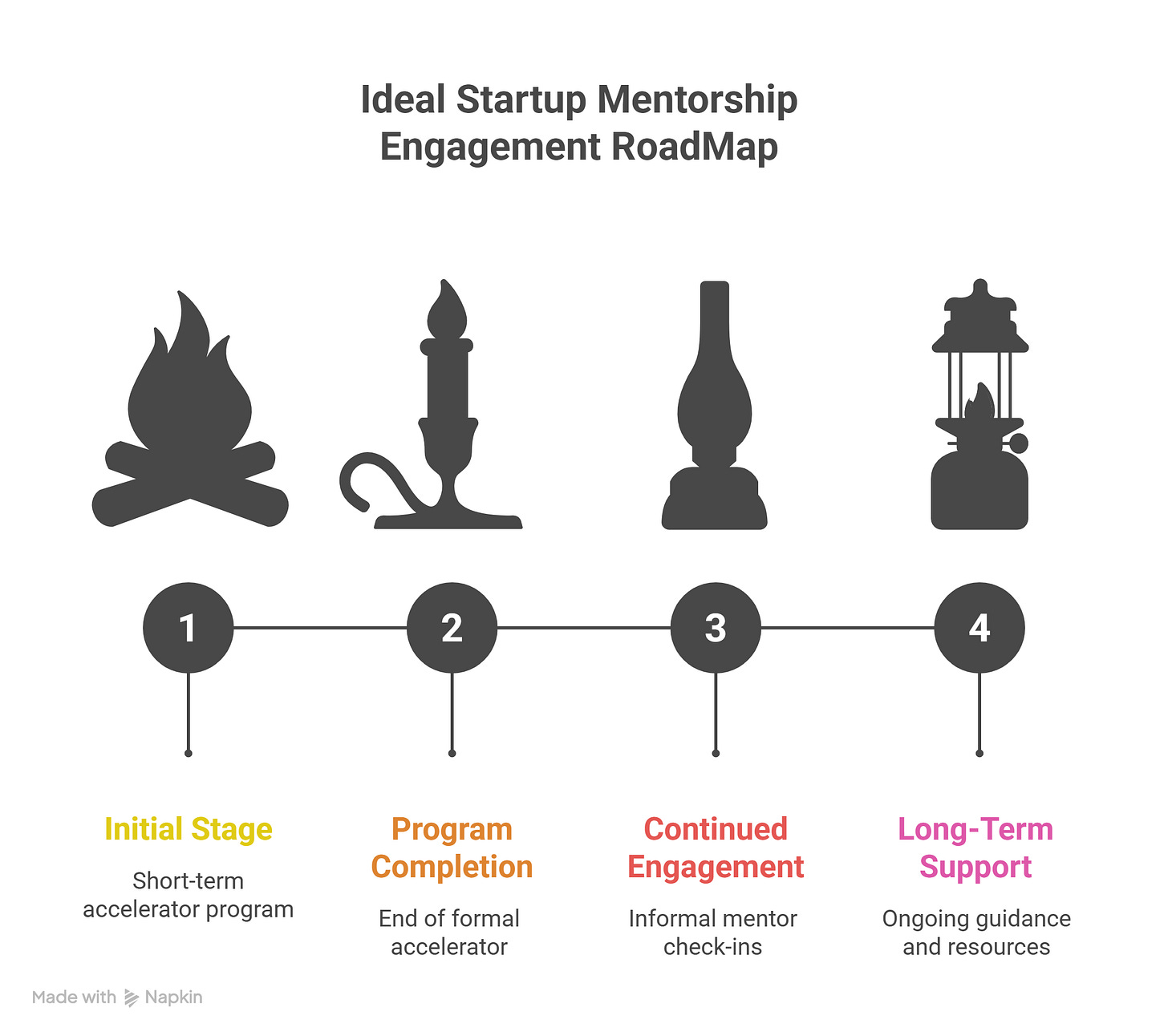

The Mentorship Mirage

Almost every accelerator promises mentorship.

But most deliver a short burst—three months, one demo day, then silence.

Long-term mentoring is rare in Mumbai’s accelerator scene. And for founders building over years (not weeks), this is a gap that slows growth, weakens clarity, and increases emotional isolation.

In this post, we spotlight Mumbai-based programs that offer deep, consistent, long-term mentoring—or at least try.

>>>Mastering Repeatable B2B Sales for Startup Growth

One of the most popular and effective modules in the 1Mby1M Curriculum is Sales 2.0 that addresses repeatable B2B Sales Strategy. With its help, many entrepreneurs have gone from 5 customers to 50, 100, 500 customers.

You can access it in three ways:

- Through 1Mby1M Premium, our full acceleration program that gives you access to our entire curriculum.

- Through 1Mby1M Basic, our Curriculum-only option.

- Through our Udemy course, B2B Sales Strategy for Tech Startups by Sramana Mitra

Remember, if you are seeking venture capital, you need Velocity.

>>>AI and Tech Startup Course Coupons for December

Artificial Intelligence is transforming every industry, giving entrepreneurs who know how to build and scale AI startups a major advantage. Our comprehensive startup course coupons are applicable to Generative AI, Machine Learning, FinTech, HealthTech, Cybersecurity, customer support automation, and more. We guide you from early ideation to advanced product strategy with real-world case studies, best practices and actionable founder frameworks.

To make it easier to dive in, we’re offering discount coupons across our entire AI course portfolio. Explore deep-dive case-study courses in Generative AI Marketing, AI Cybersecurity, FinTech, HealthTech, Services, and Machine Learning, or choose broader strategic programs like How to Bootstrap an AI Startup First and Blitzscale Later, How VC Investors Think About AI Startups, and How To Build AI / Machine Learning Startups. Engineers can also explore From Developer to Entrepreneur and AI Startup Ideas. These coupons unlock high-quality, founder-focused AI education to help accelerate your journey in the rapidly expanding AI economy.