Mastering Repeatable B2B Sales for Startup Growth

One of the most popular and effective modules in the 1Mby1M Curriculum is Sales 2.0 that addresses repeatable B2B Sales Strategy. With its help, many entrepreneurs have gone from 5 customers to 50, 100, 500 customers.

You can access it in three ways:

- Through 1Mby1M Premium, our full acceleration program that gives you access to our entire curriculum.

- Through 1Mby1M Basic, our Curriculum-only option.

- Through our Udemy course, B2B Sales Strategy for Tech Startups by Sramana Mitra

Remember, if you are seeking venture capital, you need Velocity.

>>>Featured Videos

AI and Tech Startup Course Coupons for December

Artificial Intelligence is transforming every industry, giving entrepreneurs who know how to build and scale AI startups a major advantage. Our comprehensive startup course coupons are applicable to Generative AI, Machine Learning, FinTech, HealthTech, Cybersecurity, customer support automation, and more. We guide you from early ideation to advanced product strategy with real-world case studies, best practices and actionable founder frameworks.

To make it easier to dive in, we’re offering discount coupons across our entire AI course portfolio. Explore deep-dive case-study courses in Generative AI Marketing, AI Cybersecurity, FinTech, HealthTech, Services, and Machine Learning, or choose broader strategic programs like How to Bootstrap an AI Startup First and Blitzscale Later, How VC Investors Think About AI Startups, and How To Build AI / Machine Learning Startups. Engineers can also explore From Developer to Entrepreneur and AI Startup Ideas. These coupons unlock high-quality, founder-focused AI education to help accelerate your journey in the rapidly expanding AI economy.

1Mby1M Virtual Accelerator AI Investor Forum: Yanev Suissa, SineWave Ventures (Part 1)

Yanev Suissa, Managing Partner and Founder at SineWave Ventures, discusses changes in Venture Capital and his firm’s investment thesis.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Apple’s Custom Silicon and AI Features Set the Stage for a Big Holiday Quarter

Last month, Apple (Nasdaq: AAPL) reported its quarterly earnings that outpaced all market expectations. With the recent release of new products and capabilities, Apple is forecasting a blockbuster December quarter.

>>>Top Accelerators for Entrepreneurs Who Want to Focus on Validation in Mumbai

–Kaushank Khandwala – Writer, Founder, and Pro-Founder Research Fellow

1Mby1M isn’t merely virtual — it’s built for the new generation of founders: Remote. Thoughtful. Independent. Global from Day One.

Validation is not a buzzword. It’s the bedrock of every durable startup. Before you raise, grow, or pitch—validate. But many Mumbai accelerators skip this step. They push pitches, not testing. In this post, we highlight programs that truly help founders validate their ideas before scaling.

>>>Top Accelerators in Mumbai for Solo Entrepreneurs

–Kaushank Khandwala – Writer, Founder, and Pro-Founder Research Fellow

1Mby1M isn’t merely virtual — it’s built for the new generation of founders: Remote. Thoughtful. Independent. Global from Day One.

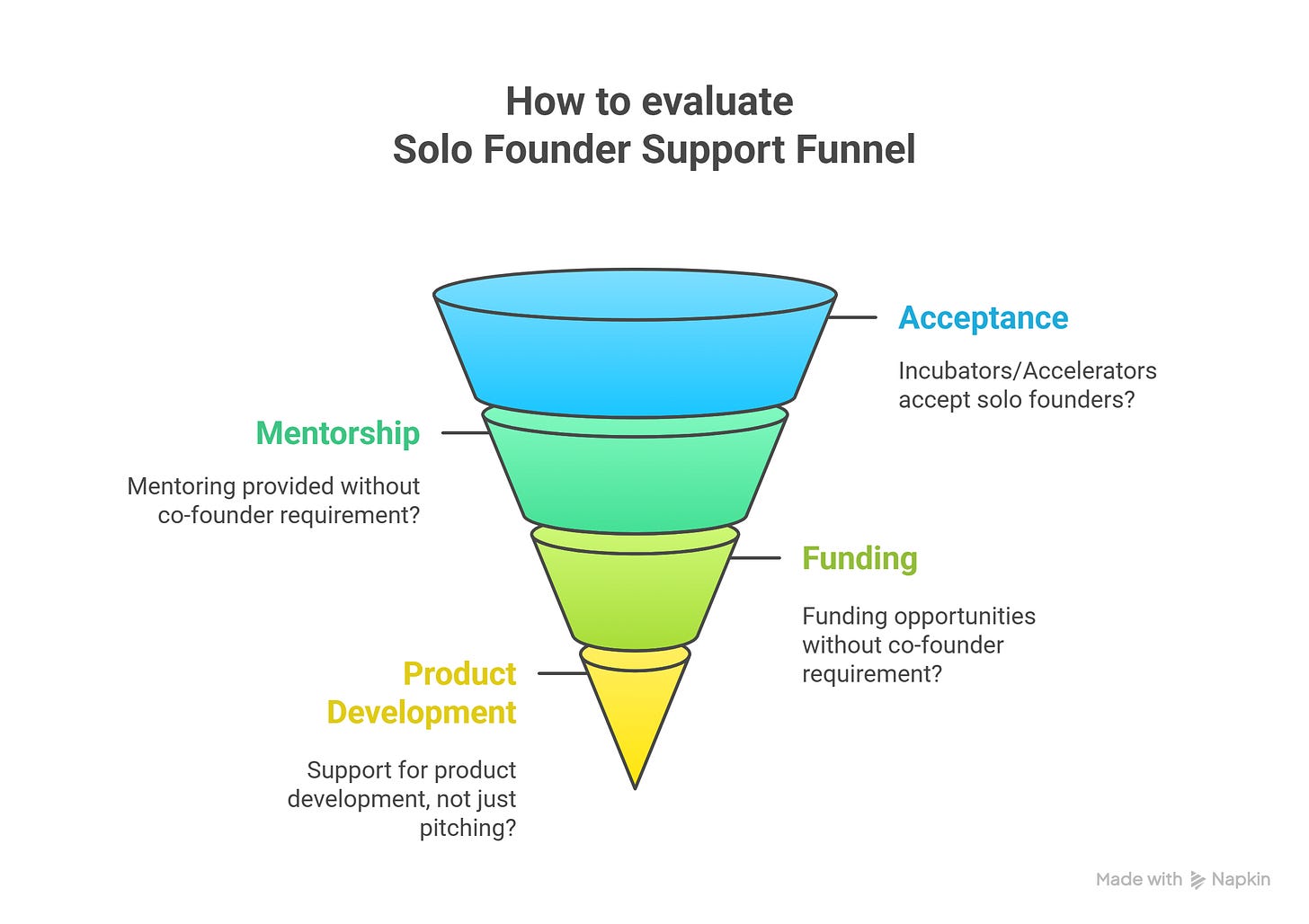

Despite all the pitch nights, incubator talks, and hackathons, one group often gets sidelined: solo founders.

>>>The Truth About Startup Fundability

There is too much money chasing too few venture scale deals. As a result, sometimes, VCs fund deals that should not be funded to appease their Limited Partners. And then, they drive these ventures to failure. Let me explain.

Let us say, you have been successful in raising $5M in venture capital.

>>>Colors: Curtains in the Wind IV

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Curtains in the Wind IV

Curtains in the Wind IV | Sramana Mitra, 2023 | Watercolor, Ink, Pastel | 9 x 12, On Paper