Opinions

Is It Normal To Start Your Own Business While Working Full-time?

Yes. Good choice. Keep going.

Bootstrapping with a paycheck is a mode of entrepreneurship that has become a major trend. Entrepreneurs are starting companies in droves while still holding onto their full-time jobs.

Two interviewers, Amina Elahi from the Chicago Tribune and Katherine Harvey from Union Tribune San Diego, recently asked me the same question: If you are bootstrapping a startup with a paycheck, when is the right time to quit?

>>>

The Unicorn Bubble Will Burst – Here’s What Will Happen Next

My Entrepreneur Journeys book “Billion Dollar Unicorns” came out in December 2014. Leading up to it and after, I have had the opportunity to interview over 50 Unicorn entrepreneurs, and another 20 or so potential Unicorns.

By now, I imagine that you have read plenty of coverage predicting the crash of 2016. Experts hastily point out that it will be nothing like the Dotcom crash when middle class savings got destroyed. No. This one will only piss away a few hundred billion dollars. The damage is well contained.

>>>

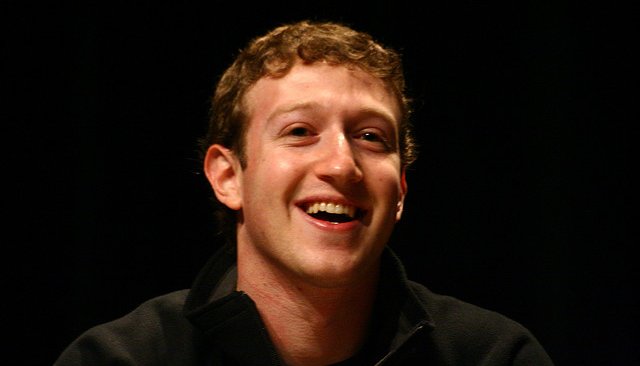

How Did Mark Zuckerberg Retain 26% Of Equity In Facebook After Raising So Much Money?

In general, my observation is that entrepreneurs retain a much higher percentage of equity if they can bootstrap their way to showing real traction, and then keep delivering solid performance metrics.

Obviously, Facebook was in high gear when Peter Thiel invested the first outside money into the company, so seed financing was not some $25k for 10% equity from an incubator. Rather, it was $500k for $10%. This started things off well, the cap table had lots of room for raising new rounds without ridiculous amounts of dilution.

Prior to the Peter Thiel investment, there was a small amount of friends and family money in the company, and by the time the first outside round took place, the company had started generating ad revenues. The valuation for this round was $5M in September 2004.

>>>

Is Y Combinator Asking for Too Much Equity for 120k Worth of Funding?

I don’t think it’s a bad deal. $120k is decent seed funding, 7% is reasonable equity for that amount. Their previous deal, I thought, sucked (6-10% equity for $15k-20k). This one is reasonable.

Recently, Sam Altman released some statistics … they’ve funded about 900 companies of which about 7 unicorns have emerged. That part of the story is great.

>>>

Incubators and Accelerators FAQs

This post answers some commonly asked questions about incubators and accelerators. I have answered these questions on Quora as well.

How Hard Is Entrepreneurship Really?

There’s a really good story on Inc. on the dark realities of entrepreneurship. Not the rah rah, everything is so wonderful kind, but the brutal emotional truth: The Psychological Price of Entrepreneurship. Read it.

What are the Most Common Ways Startups Destroy Themselves?

Chasing investors instead of customers is the most common way startups destroy themselves. It is a perfectly avoidable path to destruction.

Why is Peter Thiel NOT a Fan of the Lean Startup Movement?

This question was recently discussed on Quora. I wrote an answer there, which I have expanded on for this post.