Opinions

Women Entrepreneurs – The Myth, The Minefield, The Movement

On March 31st, I gave a talk at Hacker Dojo in Mountain View for the Women Who Code group. In it, I addressed many of the myths about being a female entrepreneur that are currently circulating in the industry. For example:

- There’s a bias against women in Silicon Valley

- You CAN and SHOULD try to DO IT ALL

- VC rejection equals sexism

- VCs hit on women

And many others.

Here’s a recording of the session. I do believe those of you who are navigating these issues would find this useful.

From $100k to $1 Million: How to Minimize Equity Dilution by Using Convertible Notes

I have always advised companies in the 1M/1M eco-system to avoid raising equity financing too soon. In fact, as a thumb rule, we advise entrepreneurs to get to enough validation such that they can get to at least a $2M pre-money valuation.

Now, if you’ve managed to get to $100k in revenue with a consistent set of customers, it is likely that you can get to the $2M minimum valuation threshold. If not, and if you must raise money, you should look at doing so on convertible notes.

In fact, during one of our recent roundtables, we had as our guest Venky Balasubramanian, co-founder of Plivo. Venky and his partner have achieved the amazing feat of growing a relatively fast growth business to well over $10 million in revenue with just $2M in angel financing.

>>>

From $100k to $1 Million: Tyranny Of The TAM

You’ve got customers.

You’ve got some level of validation.

You’ve got, perhaps, a reasonable degree of product market fit.

Now should you charge to the VCs for funding?

Wait a minute. There’s a major issue that needs assessment first and foremost.

Market Size.

What is TAM? Perhaps, the biggest factor in whether a VC funds you or not. TAM = Total Available Market.

>>>

From $100k to $1 Million: Nail the Positioning ASAP

Now that you have a few paying customers, you need to figure out how to scale to a much larger customer base. Positioning is a discipline entrepreneurs need to master especially if they have aspirations of raising money. And even if you choose not to raise money, a crisp positioning enhances your odds of success.

Professional investors – especially Venture Capitalists – care about three things in determining a good investment: Market, Team, and Technology. The priority of the three varies. Some prefer a strong team over a well-defined market opportunity, and a well-positioned business proposition. Others put market first.

I happen to belong to the latter camp. Too many times in my own experience have I seen great entrepreneurs beating their heads against markets that simply do not respond. Too often have I seen solutions from great technologists looking for problems to solve.

>>>

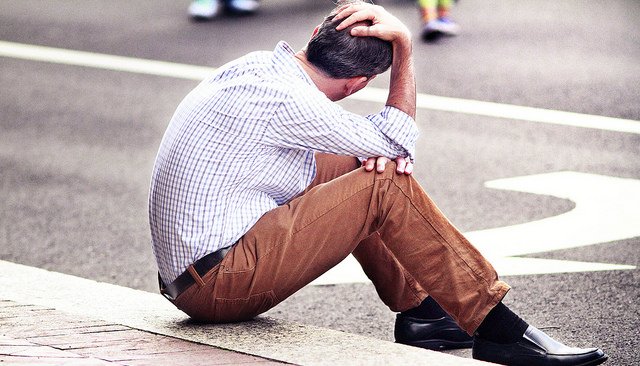

From $100k to $1 Million: How to Manage Anxiety

Startups are extremely difficult, so if you venture into this world, please assume that these challenges will come, no matter what. You will feel anxious, there will be moments of fear, self-doubt, frustration.

I can share a few tools from my own experience both as an entrepreneur, as well as from running the 1M/1M global virtual accelerator where we nurture and mentor numerous entrepreneurs.

First, I suggest you create a set of clear goals that you can follow step by step. This must include small milestones, small action items, and hence, opportunities to win small victories on a daily / weekly basis. This keeps you going, with a positive energy, and a sense that you are making progress.

>>>

What Happens After the Unicorn Carnage

Predictably, the technology industry is going through an adjustment. Many public stocks in hot sectors like cloud computing have crashed. Overvalued Unicorns are experiencing down rounds, layoffs, and all the other unsavory stuff that they deserve. More Unicorns will turn into Unicorpses as the correction continues. You could say that the industry is in bad shape.

I disagree.

The industry, actually, is full of wonderful companies that offer robust value propositions and excellent business models.

It is the market and the speculators — including the VCs who invested in the Unicorns at crazy valuations — who ran amok.

>>>

From $100k to $1 Million: Should You Join an Accelerator?

There are over 8,000 accelerators around the world. Most of them fail. Before you decide to join one, you should try to understand why they fail, so that you do not end up failing with them.

The first business accelerator in the U.S. opened in 1959 and is still operating. In the last five years, we have seen a renaissance in the accelerator business. Pioneered by YCombinator, Silicon Valley’s flagship accelerator led by Paul Graham, accelerators have come back with a vengeance. YCombinator has seen some significant successes, including Airbnb, Dropbox, and Heroku. It has fueled a bit of an accelerator bubble, in fact. Accelerators are now a global phenomenon, and there isn’t a major city in the world where an accelerator isn’t cropping up.

>>>

From $100k to $1 Million: Why Founders Get Fired

We do hear stories of founders getting fired often. It might be helpful to understand why this is such a recurring issue in entrepreneurs’ lives. I categorize the causes in three key buckets:

1) Non-performance: If a founder takes investor money and then fails to deliver on the KPIs quarter after quarter, that would be a legitimate reason for getting fired.

>>>