Startup Africa: Why the 1Mby1M Global Virtual Accelerator is a Gamechanger for Africa’s Startup Ecosystem

Africa’s startup ecosystem is buzzing with immense potential. From the vibrant tech hubs of Cape Town, Lagos and Nairobi to the growing scenes in Cairo, a new generation of entrepreneurs is emerging, ready to tackle the continent’s most pressing challenges. But as I’ve articulated extensively in my The Accelerator Conundrum blog series, the traditional support structures that have taken root here are often ill-suited to the long, arduous journey of building a great company.

>>>Featured Videos

An Overview of Startup Accelerators in Texas: Why 1Mby1M Leads the Way

By Guest Author Ajeet Virk

Over the past ten posts in this series, we’ve explored the landscape of startup accelerators in Texas, analyzing which programs provide the best support for entrepreneurs at every stage. Drawing from insights in Sramana Mitra’s The Accelerator Conundrum blog series, we examined accelerators for virtual participation, part-time founders, long-term mentorship, investor introductions, bootstrapped growth, validation, and sustainable scaling toward building real unicorns.

>>>Cloud Stocks: Symbotic Needs to Expand to New Customers

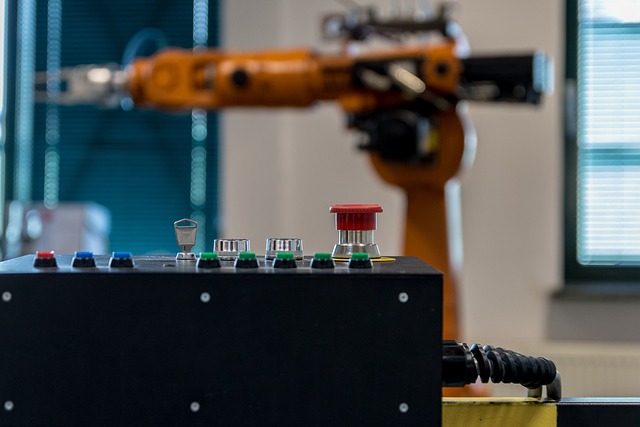

According to a market report, the warehouse automation market is expected to grow 16% annually to $115.8 billion by 2034. The market was pegged at $26.5 billion last year. The growth in the industry is driven by increasing adoption of robotics and AI to drive operational efficiency, cost savings, and speed of order fulfillment at warehouses. Symbotic (NASDAQ: SYM) recently announced a new product that is expected to meet those requirements.

>>>Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

1Mby1M Virtual Accelerator AI Investor Forum: Marina and Nick Davidov, DVC (Part 5)

Sramana Mitra: Last question—when you write a pre-seed check, what do you want to see in the company?

Nick Davidov: In the founder. At pre-seed, it’s often just one or two founders and maybe an idea.

>>>An Overview of Startup Accelerators in UK

By Guest Author Ryan Sung

Over the past ten posts in The Accelerator Conundrum series, I have explored the landscape of startup accelerators for UK-based founders, analyzing programs across multiple dimensions—from virtual access and equity terms to mentoring, investor introductions, and validation-first approaches. The research aimed to identify which accelerators truly support founders in building sustainable, fundable, and scalable businesses, rather than those that focus on short-term visibility or quick Demo Day hype.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Marina and Nick Davidov, DVC (Part 4)

Sramana Mitra: I actually have a much more interesting question to explore with you. We talked about Perplexity as a wrapper. Give me examples of other interesting wrapper companies. I think these wrapper companies are very easy to bootstrap and very desirable for people to build revenue on top of quickly. So, give me more examples of what you’re seeing.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Marina and Nick Davidov, DVC (Part 3)

Sramana Mitra: Let’s come back to the wrapper question. You started off by saying Perplexity is a wrapper on top of other LLMs.

Nick Davidov: Yes. Perplexity is actually very lean. If you compare how much money they raised, they haven’t spent much of it. They still have the majority in the bank. That’s their superpower.

>>>Colors: Door III

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – Door III

Door III | Sramana Mitra, 2023 | Watercolor, Ink, Pastel | 9 x 12, On Paper