Seed Capital

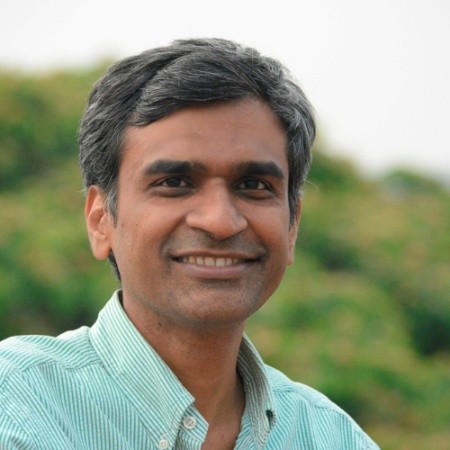

1Mby1M Virtual Accelerator Investor Forum: With Naganand Doraswamy, Managing Partner and Founder at Ideaspring Capital (Part 2)

Sramana Mitra: What is the check size that you like to write?

Naganand Doraswamy: When we started the first fund, we said anywhere around $500K to $750K. Then we would participate with another $500K in the following round. The target was about $1.25 million per company. The second is double the size.

We’re looking at $2.5 million total per company. The first check can be anywhere from $750,000 to $1.75 million. We realized that our companies needed a little bit more runway to show the traction necessary to raise the next round. $1.25 million is too small an amount to make some decisions in companies.

>>>1Mby1M Virtual Accelerator Investor Forum: With Naganand Doraswamy, Managing Partner and Founder at Ideaspring Capital (Part 1)

Naganand Doraswamy, Managing Partner and Founder at Ideaspring Capital, adds to our thesis on great investment opportunities within the sub $100 million exit space.

Sramana Mitra: Let’s start by having you introduce yourself as well as Ideaspring.

Naganand Doraswamy: I grew up in Bangalore. I did my undergrad there and then came to the US in 1999 to do my Masters in Virginia Tech. After my Master’s, I moved up to Boston. I joined FTP Software where I wrote the first implementation of IP security of Windows 95.

>>>1Mby1M Virtual Accelerator Investor Forum: With Christopher Mirabile, Senior Managing Director at Launchpad Venture Group (Part 4)

Sramana Mitra: Let’s talk about what you’re seeing in your deal flow as well as in your portfolio in terms of interesting trends. Early-stage deal flow is indicative of what’s happening in the pipeline of technology and interesting developments. What are you seeing? What’s interesting?

Christopher Mirabile: Asset prices are stupid right now. That’s difficult because doing the kind of investing you and I do, you have to be disciplined about price and about staging capital. Those are difficult circumstances. I feel like there’s a lot of hype about crypto. We’re not paying much attention to that. I’m sure that’s going to be an important technology down the road, but that’s not the focus for us.

>>>1Mby1M Virtual Accelerator Investor Forum: With Christopher Mirabile, Senior Managing Director at Launchpad Venture Group (Part 3)

Sramana Mitra: To be able to get to $20 million with $1.4 million, you have to bootstrap. That’s something we believe in and promote extensively. We are with you on this line of thinking. Like you said, these large funds can only invest large amounts of money. Otherwise, their human capital-to-capital ratio doesn’t work out.

Christopher Mirabile: They just can’t manage that many deals. It’s interesting. You read about large exits all the time. You think they grow on trees. There are a couple of dozen billion-dollar startup exits at most from 400,000 to 500,000 startups created in the US each year. Pushing an entrepreneur to a high-capital, big exit path is, statistically speaking, dooming him to failure.

>>>1Mby1M Virtual Accelerator Investor Forum: With Christopher Mirabile, Senior Managing Director at Launchpad Venture Group (Part 2)

Christopher Mirabile: We have a couple of different programs. We have a traditional monthly forum where companies that are, presumptively, ready to work with investors are present. That’s usually three companies a month. Two out of three of them go right into due diligence.

We also have a catalyst program where we look at a dozen additional companies a month. That’s not intended to be as much of an investment forum but more of an opportunity to begin a relationship. We poll the participants and give written feedback to every company. Typically, about a third isn’t going to be a fit. We’re very honest with them about that. We think it’s a sin to waste an entrepreneur’s time.

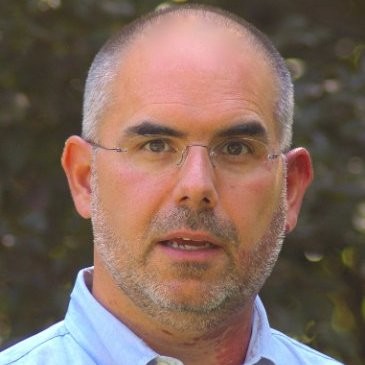

>>>1Mby1M Virtual Accelerator Investor Forum: With Christopher Mirabile, Senior Managing Director at Launchpad Venture Group (Part 1)

Christopher Mirabile is Senior Managing Director at Launchpad Venture Group. We have an awesome conversation about a non-Unicorn chasing investment philosophy.

Sramana Mitra: Tell us a bit about your background as well as Launchpad.

Christopher Mirabile: I was actually an English major. I started my career in strategy consulting. I ended up getting a law degree and worked in a very tech-focused corporate firm. I ended up taking one of my clients public. I went in-house and became an executive and ultimately the CFO.

>>>1Mby1M Virtual Accelerator Investor Forum: With BV Jagadeesh, Managing Partner at KAAJ Ventures (Part 3)

Sramana Mitra: Excellent. Is there one that you have done from India that you would like to discuss a little bit?

BV Jagadeesh: Let me take Futura. They used to be employees of MindTree. They approached me through some common connection. They hadn’t started yet at that time. They were thinking of getting into this analytics space in heavy engineering areas. Even though they came from a services background, they had the desire to do a product business.

>>>1Mby1M Virtual Accelerator Investor Forum: With BV Jagadeesh, Managing Partner at KAAJ Ventures (Part 2)

Sramana Mitra: Great! In terms of geography, you’ve invested in India and Silicon Valley. What is your group’s investment thesis in terms of geography?

BV Jagadeesh: Primarily because I like to spend more time with the entrepreneurs, I like to do more companies out of Silicon Valley. My heart is still in India. I do have about two or three companies in India. I want to limit myself with that. Otherwise, it starts to eat into my morning and evening times which are very important to me. SVQuad is primarily centered around US-based companies.

>>>