Seed Capital

1Mby1M Virtual Accelerator Investor Forum: With Michael Smerklo of Next Coast Ventures (Part 1)

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Michael Smerklo was recorded in April 2019.

Michael Smerklo, Co-Founder and Managing Director at Next Coast Ventures, talks about some of the ventures his firm has invested in and the philosophy in general.

Sramana Mitra: Let’s start by getting to know you and introducing you to our audience. Tell us a bit about yourself as well as about Next Coast.

>>>1Mby1M Virtual Accelerator Investor Forum: With Sarbvir Singh of WaterBridge Ventures (Part 1)

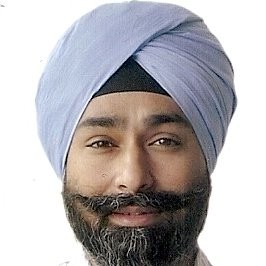

Responding to a popular request, we are now sharing transcripts of our investor podcast interviews in this new series. The following interview with Sarbvir Singh was recorded in April 2019.

Sarbvir Singh, Managing Partner at WaterBridge Ventures, talks about the firm’s India-focused investment thesis.

Sramana Mitra: Tell us about WaterBridge Ventures. What are your activities? Where are you positioning this fund? How big is this fund?

>>>1Mby1M Virtual Accelerator Investor Forum: With Taylor Greene of Collaborative Fund (Part 5)

Sramana Mitra: The next question I have for you is a slightly broader question. Are you looking for unicorns?

Taylor Greene: I think the short answer is yes. I’m always looking for unicorns. Historically, when you look at the math of venture capital, you need a unicorn in a fund in order to be a top-performing fund. The good news is we put about 35 companies into a fund.

>>>1Mby1M Virtual Accelerator Investor Forum: With Daniel Ibri of Mindset Ventures (Part 5)

Sramana Mitra: What is the scale of the consumer internet population right now in Brazil?

Daniel Ibri: We have passed the mark of more than a smartphone per person. That shows you that a huge number of the population is connected. We have very good broadband in most of the country. A lot of people use digital services.

>>>1Mby1M Virtual Accelerator Investor Forum: With Taylor Greene of Collaborative Fund (Part 4)

Sramana Mitra: In the thesis-driven situation, you are looking for a team that can execute on that thesis. In the opportunistic cases, they come to you with the ideas. If you like them and fit your world view, you would accept.

Talk about a couple of ventures that you have invested in. Also just to give us a feel for how you think about these companies, talk us through the stage at which they come to you. What is it about them that captured your attention?

>>>Roundtable Recap: June 20 – Startups, Prune Your Grapes

During this week’s roundtable, we had as our guest, Victoire Laurenty, Associate at Kerala Ventures in Paris who discussed the French eco-system.

Probus Sense

As for the entrepreneur pitch session, we first had Ankit Vaish from New Delhi, India, pitch Probus Sense, an IoT company that is focusing on the energy sector and is already generating revenues.

1Mby1M Virtual Accelerator Investor Forum: With Daniel Ibri of Mindset Ventures (Part 4)

Sramana Mitra: Are you looking for unicorn-style investments or are you also interested in the smaller niche plays that are going to have smaller exits. Let’s say $50 million to $100 million exits.

Daniel Ibri: We are interested in the smaller ones. I honestly believe that’s a very smart niche to be at this time.

Sramana Mitra: I do too.

>>>1Mby1M Virtual Accelerator Investor Forum: With Taylor Greene of Collaborative Fund (Part 3)

Sramana Mitra: Tell me about the kinds of B2C ventures you like to invest in. Besides the ventures doing good element, is there other parameterization that you could put on your preferred investments?

Taylor Greene: I try to simplify as much as possible. It’s my job to find outstanding entrepreneurs with breakthrough ideas who are solving big problems in markets that are either big already or that could grow into something huge. I’m always looking for that.

>>>