December 19 – 666th 1Mby1M Mentoring Roundtable for Entrepreneurs

Entrepreneurs are invited to the 666th FREE online 1Mby1M Mentoring Roundtable on Thursday, December 19, 2024, at 8 a.m. PST / 11 a.m. EST / 5 p.m. CET / 9:30 p.m. India IST.

If you are a serious entrepreneur, register to “pitch” and sell your business idea. You’ll receive straightforward feedback, advice on next steps, and answers to any of your questions. Others can register to “attend” to watch, learn, and interact through the online chat.

You can learn more here and REGISTER TO PITCH OR ATTEND HERE. Register and you will receive the recording by email, even if you are unable to attend. Please share with any entrepreneurs in your circle who may be interested. All are welcome!

Featured Videos

665th 1Mby1M Entrepreneurship Podcast with Investor Gus Tai (Part 2, 2024)

Gus Tai, Investor, Board Member and Retired General Partner at Trinity Ventures, discusses ideas and opportunities in Education with an AI-augmented framework.

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Google Play | Stitcher | TuneIn | RSS

665th 1Mby1M Roundtable Recording

In case you missed it, you can listen to the recording of this roundtable here:

Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

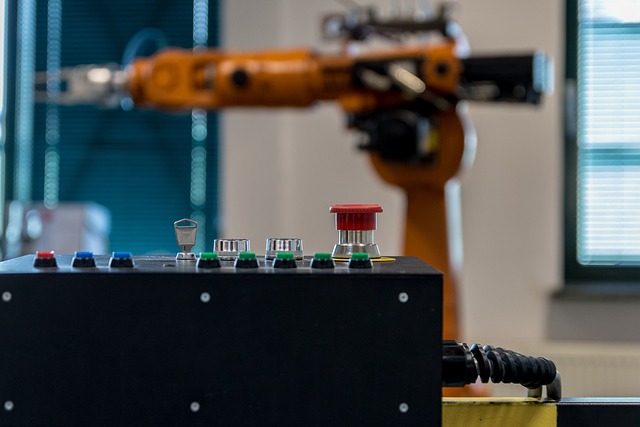

Cloud Stocks: Symbotic Leverages AI to Provide Warehousing-as-a-Service

The rise of AI in the recent past has exposed some interesting use-cases across industries. One such example is that of Wilmington, Mass.-based software and robotics maker Symbotic (NASDAQ: SYM), who has successfully leveraged AI to build an offering of Warehouses-as-a-Service.

>>>Roundtable Recap: December 12 – AI in Education Investment Thesis with Investor Gus Tai

During this week’s roundtable, we had Gus Tai, Investor, Board Member and Retired General Partner at Trinity Ventures discuss ideas and opportunities in Education with an AI-augmented framework.

HiringKit

As for our entrepreneur pitch, Naveen Chandupatla from Atlanta, Georgia, pitched HiringKit, a resume-screening product.

You can listen to the recording of this roundtable here:

1Mby1M Virtual Accelerator AI Investor Forum: With Krishnakumar Natarajan, Co-Founder of Mela Ventures (Part 4)

Sramana Mitra: Yes, definitely. I also want to ask you about your current strategy of investing in AI companies. It sounds like this is a team that you really liked; and you invested in that team and the concept. How often do you do that? Do you invest in concepts much?

>>>1Mby1M Virtual Accelerator AI Investor Forum: With Krishnakumar Natarajan, Co-Founder of Mela Ventures (Part 3)

Sramana Mitra: So, tell me, what AI companies have you invested in? Let’s do a few case studies and as you are describing them, talk about why you have invested in those companies.

>>>Cloud Stocks: Veeva Accelerates AI Initiatives

Veeva’s (NYSE: VEEV) recently announced quarterly results continue to impress the market. Veeva is adding AI capabilities to several of its offerings as it continues to successfully migrate its customers over to Vault CRM.

>>>