The Accelerator Conundrum: The Premature Blitzscaling Pressure

One of the most insidious pressures exerted by the typical 3-month accelerator model is the relentless push for premature blitzscaling.

The entire program is geared towards showing rapid growth metrics by Demo Day, regardless of whether that growth is sustainable, profitable, or even desirable at such an early stage.

This focus on manufactured velocity, more often than not, becomes a recipe for disaster, not genuine disruption.

True business building is an iterative process. You first need to achieve deep product-market fit, understand your customer acquisition channels, and validate your business model at a small, manageable scale.

Only then should you consider blitzscaling.

Accelerators, however, often reverse this logical sequence. They push founders to acquire users, generate velocity and expand operations before they truly understand their unit economics or have solidified their core offering.

This premature scaling leads to churn, an unsustainable burn rate, a desperate chase for vanity metrics, and a constant need for more funding to keep the artificial growth engine sputtering along.

You end up hiring too fast, spending too much on marketing, and generally expanding before your foundations are solid.

This isn’t building a resilient business. It’s inflating a balloon that’s prone to bursting.

Many promising startups have withered and died from being forced to blitzscale before they were ready.

Balloons, inevitably, burst.

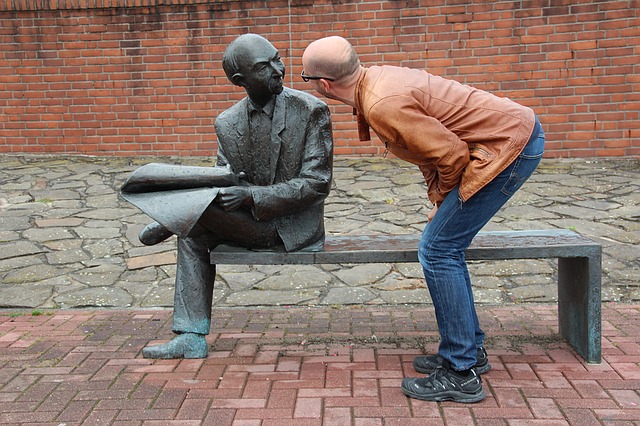

Photo Credit: WikiImages from Pixabay

Featured Videos

The Accelerator Conundrum: The Herd Mentality and Groupthink Trap

When you gather a cohort of startups, put them through the same program, expose them to the same “mentors,” and push them towards the same Demo Day objective, you inevitably foster a dangerous phenomenon: the herd mentality and groupthink trap.

>>>What Makes Your Startup Hard to Copy

AI is making it easy to build ultralight startups. AI is also making it easy for copycats to flood the market with competing products. Investors HATE a market full of copycats. If you are looking to raise funding, you have to be able to establish a defensibility thesis.

By and large, if you are building something that plugs some short term technology gap in a larger AI platform, that is not a defensible play.

Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

The Accelerator Conundrum: The Demo Day Delusion – A Launching Pad or a Showcase for Performative Entrepreneurship?

Ah, Demo Day. The grand finale. The culmination of the 3-month sprint.

It’s presented as the ultimate launching pad, your moment in the spotlight to capture the attention of investors, media, and potential partners, securing that coveted follow-on funding.

>>>The Accelerator Conundrum: The Mentor Mismatch

Let’s address another glittering promise that often turns to dust: the “mentor network.”

Every accelerator boasts an impressive roster of advisors, entrepreneurs-in-residence, and industry veterans, all touted as eager guides ready to share their wisdom.

The reality, however, is frequently a chaotic mentor carousel, marked by superficial interactions and a profound lack of genuine, consistent engagement.

>>>The Accelerator Conundrum: The One-Size-Fits-None Fallacy

One of the most glaring deficiencies of the traditional 3-month accelerator model is its inherent one-size-fits-none approach.

These programs operate on a batch system, putting dozens of diverse startups, across myriad industries and stages, through the exact same motions.

>>>1Mby1M Virtual Accelerator AI Investor Forum: Warren Packard, AI Fund (Part 2)

Sramana Mitra: So, the obvious question that stems out of what you described is, how do you identify or qualify the founder who’s fit for this kind of a model?

>>>Cloud Stocks: Analysis of Wix.com’s Base44 Acquisition

According to a recent report, the global website builder software market is estimated to grow 7% annually from $2.4 billion to $3.8 billion by 2032. Wix.com (Nasdaq: WIX) is expanding its presence in the market by adding to its AI capabilities.

>>>