Best of Bootstrapping: Why 99% of Entrepreneurs Face Rejection and How to Overcome It

If you haven’t already, please study our free Bootstrapping Course and Investor Introductions page.

Let’s start with a quote from Marc Andreessen:

“At our venture capital firm we only invest in a sort of Silicon Valley–style tech. We see 3,000 inbound deals a year. And those are inbound and coming through our referral network, so those are sort of prequalified. We can do maybe 15 or 20 investments out of the 3,000 a year. So I like to say our day job is crushing entrepreneurs’ hopes and dreams. Our main skill is saying no, and getting people to not hate us.” Source: Inside the mind of Marc Andreessen – Fortune Management

I run One Million by One Million (1Mby1M), a global virtual accelerator for startups. 2023 is our thirteenth year supporting entrepreneurs.

Thousands upon thousands of entrepreneurs have approached us for help with their funding at a stage where their chances of getting funding is ZERO. We can’t help them, regardless of how powerful our investor connections are. We can’t help a startup get funding before they become fundable. It pains me to see how many entrepreneurs have no idea what makes a startup fundable.

Featured Videos

Analysis of Databricks’ AI Acquisitions

According to a recent report, the Data Science Platforms market is estimated to grow at 16% CAGR to reach $378.7 billion by 2030 from $96.3 billion in 2021. Databricks, a leading data analytics solution provider, is seeing strong growth as well and is gearing up to go public soon.

>>>Best of Bootstrapping: Why Bootstrapping is So Important

If you haven’t already, please study our Bootstrapping Course and Investor Introductions page.

You may have read my Bootstrapping to an Exit piece, where I highlighted the importance of facilitating capital-efficient startups and smaller exits, including with small chunks of investment.

In working through the current landscape of our industry, a few trends become evident:

- A large percentage of VCs are chasing Unicorns

- Too much money chasing too few deals capable of delivering hyper growth bids up valuations

- Many Death by Overfunding tragedies have emerged

- Entrepreneurs are reacting, as Erin Griffith points out in her NY Times article: More Start-Ups Have an Unfamiliar Message for Venture Capitalists: Get Lost

Video FAQs

Can 1M/1M Help Me Raise Money?

How Does 1M/1M Democratize Entrepreneurship Education?

How Does 1M/1M Democratize Management Consulting?

When Is The Right Time To Join 1M/1M?

Can 1M/1M Help Me With Business Development?

Can 1M/1M Help Me With Market Sizing?

Can 1M/1M Help Me Validate My Product?

Will I Have Private 1-on-1 Sessions In 1M/1M?

How Does 1M/1M Help Entrepreneurs Connect With Silicon Valley?

Mentoring or Consulting?

Why Does 1M/1M Charge $1000 a Year?

Why Does 1M/1M Partner With Local Organizations?

Why Don\’t Mentoring Networks Work?

Why Is It Important To Study With 1M/1M Now?

Dan Stewart Story

Vikrant Mathur Story

Catching Up On Readings: Intelligent Apps

This feature from Gartner looks at the growing demand for intelligent apps powered by AI. By 2026, 30% of new applications are expected to use AI to drive personalized adaptive user interfaces, up from less than 5% today. For this week’s posts, click on the paragraph links.

>>>Building a Fashion E-commerce Business and Surviving Covid: Go Dash Dot CEO Hannah Fastov (Part 7)

Sramana Mitra: Did revenue take a hit in 2020?

Hannah Fastov: It did. That was when we were able to see the benefits of the direct to consumer business that we had built. It remained equal to the year prior.

Sramana Mitra: You did $2 million in 2020?

Hannah Fastov: Yes.

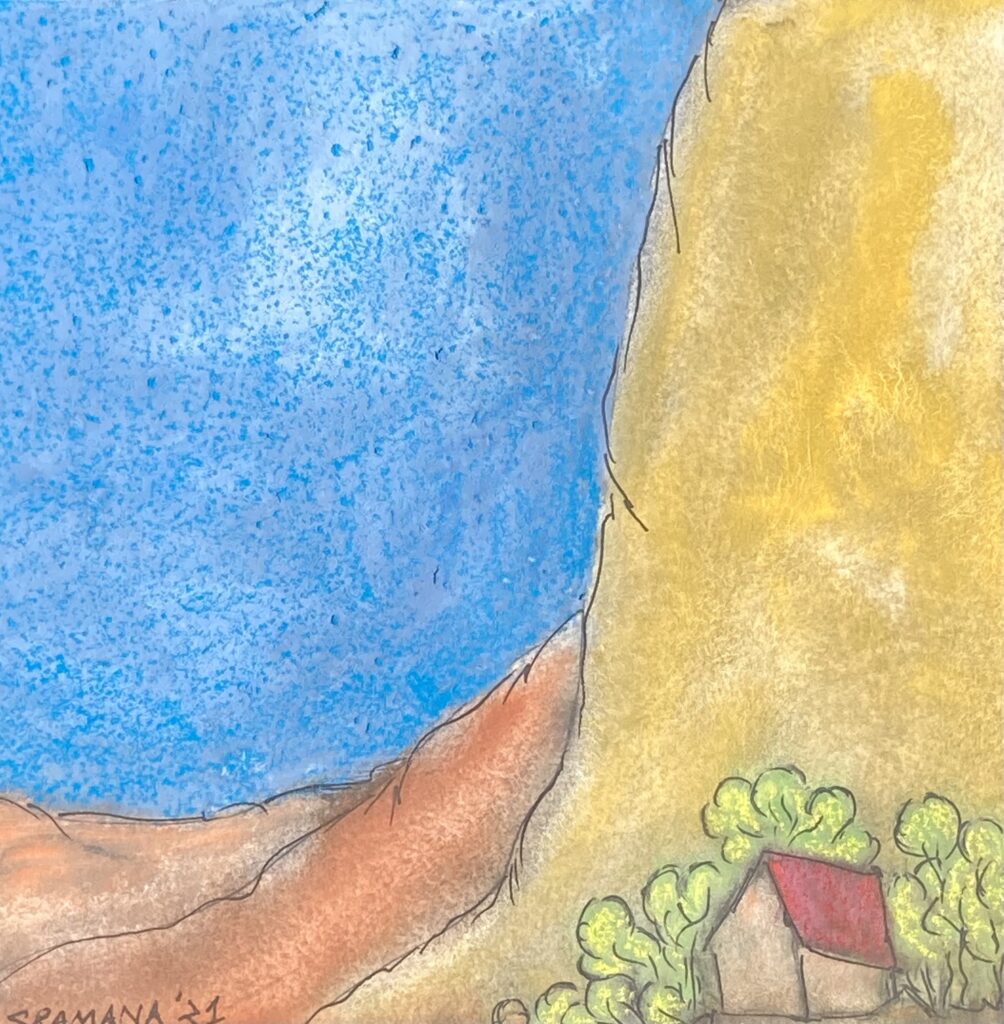

>>>Colors: L’hermitage IV

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – L’hermitage IV

L’hermitage IV | Sramana Mitra, 2021 | Watercolor, Pastel, Brush Pen | 8 x 8, On Paper

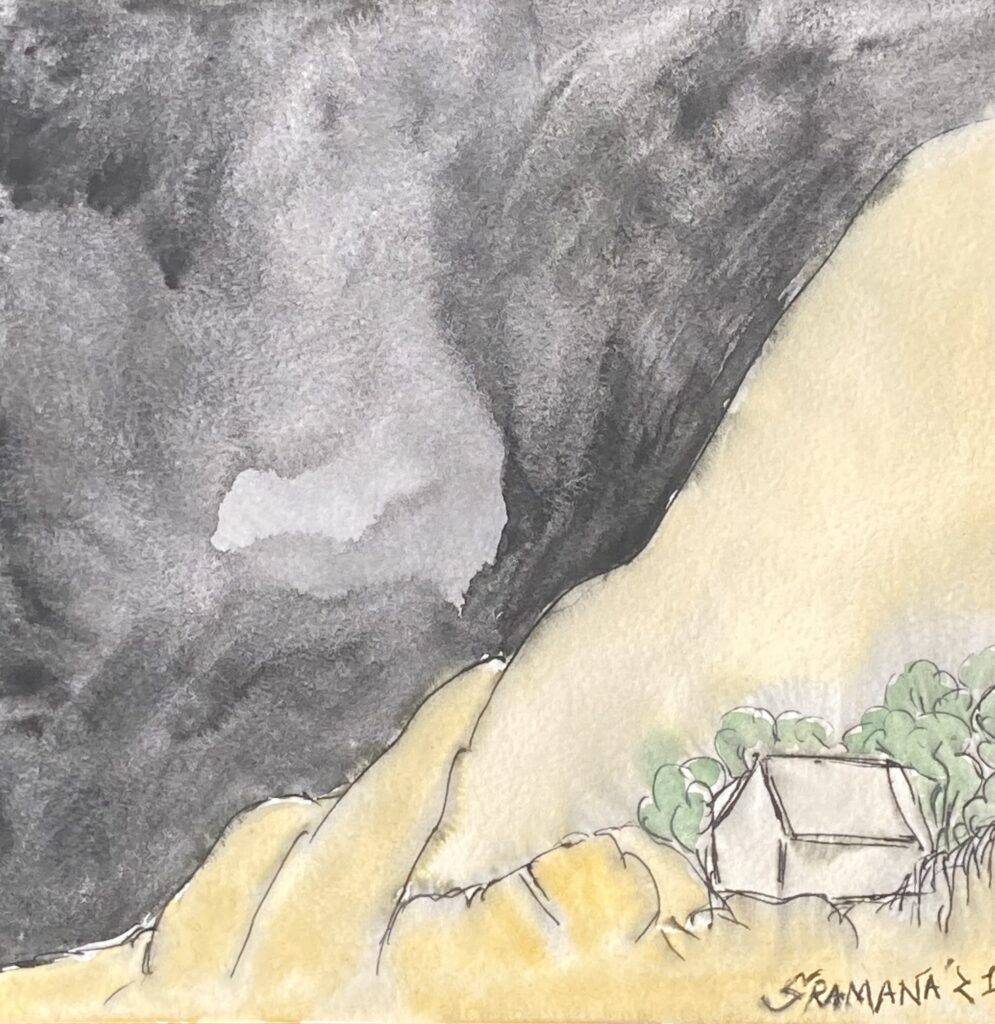

Colors: L’hermitage III

I’m publishing this series on LinkedIn called Colors to explore a topic that I care deeply about: the Renaissance Mind. I am just as passionate about entrepreneurship, technology, and business, as I am about art and culture. In this series, I will typically publish a piece of art – one of my paintings – and I request you to spend a minute or two deeply meditating on it. I urge you to watch your feelings, thoughts, reactions to the piece, and write what comes to you, what thoughts it triggers, in the dialog area. Let us see what stimulation this interaction yields. For today – L’hermitage III

L’hermitage III | Sramana Mitra, 2021 | Watercolor, Pastel, Brush Pen | 8 x 8, On Paper

Building a Fashion E-commerce Business and Surviving Covid: Go Dash Dot CEO Hannah Fastov (Part 6)

Sramana Mitra: What level did you reach in 2019?

Hannah Fastov: In 2019, we did $4 million. Then the pandemic hit.

Sramana Mitra: How did that go?

Hannah Fastov: That was an interesting time for us. We’re selling an on-the-go bag and everybody’s staying home. We just had our shipment come in at the beginning of March 2020. All of our wholesale partners either postponed or cancelled their orders. We had a ton of inventory.

>>>